ECO 10 Solved Question Paper June 2018

ECO - 10: ELEMENTS OF COSTING SOLVED QUESTION PAPERS

ELEMENTS OF COSTING

IGNOU BCOM SOLVED QUESTION PAPERS

BACHELOR'S DEGREE PROGRAMME

Term-End Examination: June 2018

ELECTIVE COURSE: COMMERCE

Time: 2 hours; Maximum Marks: 50; (Weightage: 70%)

Term-End Examination: June 2018

ELECTIVE COURSE: COMMERCE

Time: 2 hours; Maximum Marks: 50; (Weightage: 70%)

Note: Attempt any two questions from Section-A and any two questions from Section-B.

Eco 10 Solved Question Papers Elements of Costing | |

SECTION - A

1. Explain the various steps usually followed by firms in purchase of

materials. 10

Ans: Process of purchasing and

receiving goods

Purchase procedure differs from business to business, but all of

them follow a general pattern or procedure. There should be proper Purchase

Procedure to ensure that right type of material is purchased at right time, in

right quantity, at right prices and at right place. All these things require a

well-defined procedure of purchasing. The steps in Purchase Procedure are

explained below.

Purchase

Requisition: A form known as ‘Purchase Requisition’ is commonly used as a

format requesting the purchase department to purchase the required material.

Normally the purchase requisition is issued by the Stores Department when the

quantity of the concerned material reaches the minimum level. Only in the cases

of materials, which are not kept in the stores on regular basis, the

requisition is issued by the concerned department. Purchase requisition has

information like the quantity required, the expected date of receipt, the

department in which the material is required, description of material etc.

Copies of the purchase requisition are sent to the Accounts department and the

concerned department who is in need of the material.

Purchase Order: After the receipt

of purchase requisition, the purchase department places an order with a

supplier, offering to buy certain material at stated price and terms. However

before issuing the purchase order, quotations may be invited from various

suppliers for arriving at the best deal. The purchase department usually keeps

a list of suppliers from whom the quotations are invited. The quotations

received are examined on various parameters like price, delivery period, terms

and conditions, quality of material etc. After this, purchase order is issued

to the selected supplier. It should be remembered that a purchase order is a

legal document and it results into a contract between the company and the

supplier. Hence the terms and conditions in the purchase order should be

drafted clearly without any ambiguity.

Receiving the

Materials: The

receiving department performs the function of unloading and unpacking materials

which are received by an organization. This will need an inspection report

which is sometimes incorporated in the receiving report, indicating the items

accepted and rejected with reasons. Copies of the receiving report along with

the inspection report are sent to various departments like purchase, stores,

concerned department, accounts department and costing department.

Approval of

invoice: Approval

of invoice indicates that goods according to the purchase order have been

received and payments can be made for the same. However if the goods are not

according to the quality ordered or are in excess of the quantity specified or

are damaged or are of inferior quality, payment is withheld.

Making the Payment:

After

the invoice is approved the payment is made to the supplier. The purchase

procedure is completed with the payment released.

2. (a) Distinguish between Cost Accounting and Financial Accounting. 5, 5

Ans: DISTINGUISH BETWEEN FINANCIAL AND

COST ACCOUNTING

|

Basis |

Financial

Accounting |

Cost

Accounting |

|

1. Nature |

Financial

accounts are maintained on the basis of historical records. |

Cost

accounts lay emphasis on both historical and predetermined costs. |

|

2. Use |

Financial

Accounting is used even by outside entities. |

Cost

Accounting is used only the management of the concern. |

|

3. System |

Financial

Accounting uses the double-entry system for recording financial data. |

Cost

Accounting does not use the double-entry for collecting cost data. |

|

4. Scope |

Financial

Accounting covers all items of income and expenditure whether related to the

cost centers or not, |

Cost

Accounting covers all items related to a cost centre. |

|

5. Reports |

Financial

Accounting results are shown P&L A/c and balance sheet. |

Cost

Accounting results are shown in Cost Sheet/ Coating Profit & Loss A/c/

Reports Contract A/c/ Process A/c. |

(b) State the main objectives of cost accounting.

Ans: Objectives/functions of Cost

Accounting

According to Blocker and Weltemer, “Cost

Accounting is to serve management in the execution of polices and in comparison

of actual and estimated results in order that the value of each policy may be

appraised and changed to meet the future conditions”. The main

objectives/functions of cost accounting are:

1) Ascertain Cost: To

ascertain the cost of product or a services reveled and enable measurement of

profit by proper valuation of inventory.

2) Analyse Costs: To

analysis costs or to classify the expenses under different heads of accounts

viz. material, labour, expenses etc.

3) Allocate and Apportion the Costs: To

allocate or charge the direct expenses or specific costs such as Raw Material,

Labour to particular product, contract or process and to distribute common

expenses to each product, contract or process on a suitable basis.

4) Cost Reporting: Cost

Reporting or presentation includes:

a) What to report i.e. what is the nature of

information to be presented?

b) Whom to Report i.e. to whom the report is

to be addressed.

c) When to Report i.e. when the report is to

be presented i.e. Daily weekly monthly yearly etc.

d) How to Report i.e. in what format the

report is to be presented.

5) Assist the Management: Cost

Accounting assist the management in the following ways

a) Indicate to the management any

inefficiencies and extent of various forms of waste of Raw Material, Time,

Expenses etc.

b) Help the management in fixing of selling

price.

c) Provide information to enable management to

take decision of various types.

6) Cost Control: Cost

Accounting assist the management in cost control. Cost control includes the

following stages.

a) Setting up of targets of cast and

production for each period.

b) Measuring the actual figures of performance

relating to cost, production etc. for the period concerned.

c) The figures of actual performance are to be

compared with the targets to find out the variation. d) Analysing the variance,

whether favourable or adverse. e) Immediate action has to be taken in case of

adverse variation.

7) Controlling Inventory: Assist the

management in controlling Inventory of Raw Material, goods in process, finished

goods, spares and consumables etc.

8) Optimum Product Mix: Advise the

management in deciding optimum product mix merits and demerits of alterative

courses of action viz. make of buy decisions, introduction or Automation

mechanization, rationalization, system of production etc.

9) Future Policies: Advise

management on future policies regarding Expansion, growth, capital investment,

etc.

3. Write a short notes on any two of the following: 5, 5

a) Cost sheet

Ans: Cost Sheets

are statements setting out the costs of a product giving details of all the

costs. Presentation of costing information depends upon the method of costing.

A cost sheet can be prepared weekly, monthly, quarterly or annually. In a cost

sheet besides total expenditure incurred, cost per unit of output in case of

each element of cost can be shown in a separate column. The cost sheet should

give cost per unit in the previous period for the purposes of comparison.

Walter

& Bigg define, “The expenditure which has been incurred upon production for

a period is extracted from the financial books and the store records, and set

out in a memorandum or a statement. If this statement is confined to the

disclosure of the cost of the units produced during the period, it is a termed

as a cost sheet”. In other words cost sheet is a statement showing the total

cost under proper classification in a logical order.

Components of Total Cost

1.

Prime Cost: Prime cost consists of costs of direct materials, direct labors and

direct expenses. It is also known as basic, first or flat cost.

2.

Factory Cost: Factory cost comprises prime cost and, in addition, works or

factory overheads that include costs of indirect materials, indirect labors and

indirect expenses incurred in a factory. It is also known as works cost,

production or manufacturing cost.

3.

Office Cost: Office cost is the sum of office and administration overheads and

factory cost. This is also termed as administration cost or the total cost of

production.

4.

Total Cost: Selling and distribution overheads are added to the total cost of

production to get total cost or the cost of sales.

b) Economic Order Quantity

Ans: Economics

order quantity: Economics order quantity represents the size

of the order for which both order, ordering and carrying costs together are

minimum. If purchases are made in large quantities, inventory carrying cost

will be high. If the order size is small, ordering cost will be high. Hence, it

is necessary to determine the order quantity for which ordering and carrying

costs are minimum. The formula used for determining economics order quantity is

a s follows:

Where,

A is the annual consumption of material

in units.

O is the cost of placing an order

(ordering cost per unit)

C is the cost of interest and storing

one unit of material for the one year (carrying cost per unit per annum).

c) Time keeping

Ans: TIME-KEEPING: This

department is concerned with maintenance of attendance time and job time of workers. Attendance time is

recorded for wage calculation and job time or time booking is considered for computing time spent for each

department, job, Operation and

Process for calculating labour cost department wise, job wise and of each process and operation.

Essentials of a good Time-keeping System

1. Good time keeping system prevents ‘proxy’

for one another among workers

2. Time-keeping has to be done for even piece

workers to maintain uniformity, regularity

and continuous flow of production.

3. Both the arrival and exit of workers is to

be recorded so that total time spent by workers

is available for wage calculations.

4. Mechanized methods of time keeping are to

be used to avoid disputes.

5. Late arrival time and early departure time

are to be recorded to maintain discipline.

6. The time recording should be simple, quick

and smooth.

7. Time recording is to be supervised by a

responsible officer to eliminate irregularities.

Methods of time

keeping

1. Time Recording

Clocks or Clock Cards: This is mechanized method of time recording.

Each worker punches the card given

to him when he comes in and goes out. The time and date is automatically recorded in the card. Each week a new card is

prepared and given to the worker so

that weekly calculation of wages will be possible.

2. Disc Method: This is

one of the older methods of recording time. A disc, which bears the identification number of each worker,

is given to each one. When the worker comes in, he picks up his disc from the tray kept near the gate of the factory and

drops in the box or hooks it on a board

against his number. Same procedure is followed at the time of leaving the

factory. The box is removed at

starting time, and the time keeper becomes aware of late arrivals by requiring

the workers concerned to report him

before starting. The time keeper will record in an Attendance Register any late arrivals and workers

leaving early. He will also enter about the absentees in the register on daily basis.

3. Attendance

Records: This is the simplest and the oldest method of marking attendance

of workers. In this method, every

worker signs in an attendance register against his name. Leaves taken by workers as well as late reporting is

marked on the attendance register itself.

d) Contract costing

Ans: Contract Costing: This

method if applied in undertakings erecting buildings or carrying out

constructional works, e.g., House buildings, ship building, Civil Engineering

contracts. Here the cost unit is one and completed in itself. The cost unit is

a contract which may continue for over more than a year. It is also known as

the Terminal Costing, since the works are to be completed within a specified

period as per terms of contract or agreement executed by the contractor and

contractee.

SECTION - B

4. (a) Prepare the Process - 'A' and Process -

'B' accounts from the following data : 10,

5

|

Particulars |

Process |

|

|

A |

B |

|

|

Material (Rs.) Labour (Rs.) Overheads (Rs.) Normal Loss Sales value of wastage per unit (Rs.) |

30,000 10,000 7,000 10% 1 |

3,000 12,000 8,600 4% 2 |

There is no opening and closing stock.

20000 units of material were used in Process – A. The output from Process – A

was 17,500 units and from Process – B was 17,000 units

Solution:-

(b) State five importance differences between

job costing and Process costing.

Ans: Difference between Job costing

and Process Costing

|

Basis of distinction |

Job Costing |

Process Costing |

|

Basic |

Job costing is used when the cost object is an individual (or a lot/batch)

unit or a distinct product or service. |

Process Costing is generally used for a mass of identical

product or service. |

|

Accumulation of Cost |

Costs can be accumulated by each individual product or service. |

The Costs are accumulated in a period. The total costs in a

period are divided over the number of units to get an average unit cost. |

|

Cost Determination |

Job costing is done against a specific order being produced. |

Costs are compiled for each process over a period of time. |

|

Cost Calculation |

Costs are calculated when a job is over. |

Costs are calculated at the end of a cost period like an

accounting year. |

|

Transfer |

There are usually no transfers of costs from one job to another. |

Transfer of costs from one process to another is made as the

product moves from one process to the other. |

|

Forms and Details |

There is more paper work. |

It has lesser paper work. |

|

Inventory |

There is little or no inventory. |

There is regular and significant inventory. |

|

Mechanization |

It is less amenable to mechanization & automation. |

It is more amenable to mechanization & automation. |

5. The following is the record of receipts and

issues of a certain material in the factory during a week. 15

|

Jan.

1 Jan.

1 Jan.

2 Jan.

3 Jan.

4 Jan.

5 Jan.

6 Jan.

7 |

Opening Balance Issued Received Issued Received back Issued Received Issued |

50 tonnes @ Rs. 10 per ton 30 tonnes 60 tonnes @ Rs. 10.20 per ton 25 tonnes (Stock verification reveals a loss

of 1 tonne.) 10 tonnes (previously issued from orders at

Rs. 19.15 per ton) 40 tonnes 22 tonnes @ Rs. 10.30 per ton 36 tonnes |

Prepare Stores Ledger Account using LIFO

method.

Solution:-

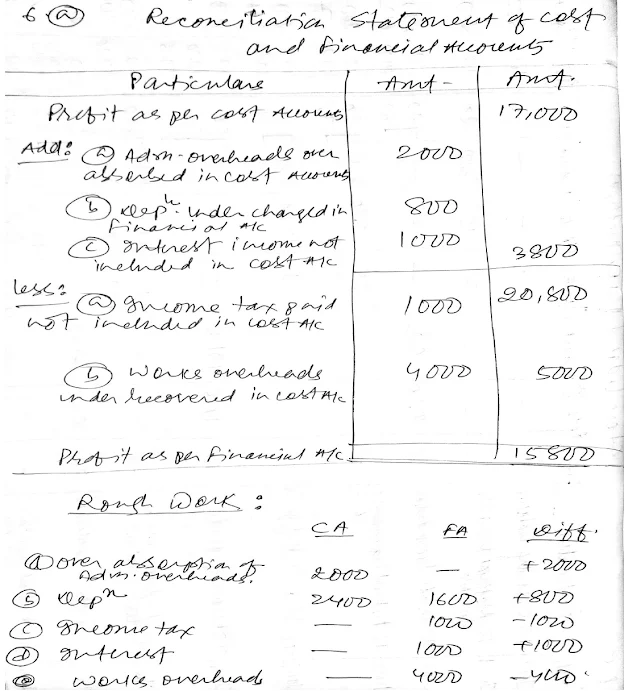

6. (a) From the following figures prepare a

reconciliation statement of Cost and Financial Accounts. 10, 5

|

|

(Rs.) |

|

Profit as per Cost Accounts 1)

Over absorption

of administrative overheads in Cost Accounts 2)

Depreciation

charged in Cost A/c 3)

Depreciation

charged in financial A/c 4)

Income Tax paid

not include in Cost A/c 5)

Bank Interest

income not included in Cost A/c 6)

Work overheads

under – recovered in Cost A/c |

17,000 2,000 2,400 1,600 1,000 1,000 4,000 |

Solution:-

(b) Piece Rate 20 per unit standard

output 24 units per day of 8 hours

output of 'A' - 21 units

output of 'B' - 25 units

compute wages of A and B under Merrick

Differential Piece Rate System.

Solution:-

Post a Comment

Kindly give your valuable feedback to improve this website.