ECO 10 Solved Question Paper June 2015

ECO - 10: ELEMENTS OF COSTING SOLVED QUESTION PAPERS

ELEMENTS OF COSTING

IGNOU BCOM SOLVED QUESTION PAPERS

BACHELOR'S DEGREE PROGRAMME

Term-End Examination: June 2015

ELECTIVE COURSE: COMMERCE

Time: 2 hours; Maximum Marks: 50; (Weightage: 70%)

Term-End Examination: June 2015

ELECTIVE COURSE: COMMERCE

Time: 2 hours; Maximum Marks: 50; (Weightage: 70%)

Note: Attempt any two questions from Section-A and any two questions from Section-B.

Eco 10 Solved Question Papers Elements of Costing | |

SECTION — A

1. (a) State the objectives of cost

accounting. 5+5

Objectives/functions of

Cost Accounting

According to Blocker and Weltemer, “Cost

Accounting is to serve management in the execution of polices and in comparison

of actual and estimated results in order that the value of each policy may be

appraised and changed to meet the future conditions”. The main objectives/functions

of cost accounting are:

1) Ascertain Cost: To

ascertain the cost of product or a services reveled and enable measurement of

profit by proper valuation of inventory.

2) Analyse Costs: To

analysis costs or to classify the expenses under different heads of accounts

viz. material, labour, expenses etc.

3) Allocate and Apportion the Costs: To

allocate or charge the direct expenses or specific costs such as Raw Material,

Labour to particular product, contract or process and to distribute common

expenses to each product, contract or process on a suitable basis.

4) Cost Reporting: Cost Reporting

or presentation includes:

a) What to report i.e. what is the nature of

information to be presented?

b) Whom to Report i.e. to whom the report is

to be addressed.

c) When to Report i.e. when the report is to

be presented i.e. Daily weekly monthly yearly etc.

d) How to Report i.e. in what format the

report is to be presented.

5) Assist the Management: Cost

Accounting assist the management in the following ways

a) Indicate to the management any

inefficiencies and extent of various forms of waste of Raw Material, Time,

Expenses etc.

b) Help the management in fixing of selling

price.

c) Provide information to enable management to

take decision of various types.

(b) Write note on ABC Analysis as a technique

of inventory control.

ABC Analysis: ABC System: In this technique, the items of inventory are classified according to the value of usage. Materials are classified as A, B and C according to their value.

Items in class ‘A’ constitute the most important class of

inventories so far as the proportion in the total value of inventory is

concerned. The ‘A’ items constitute roughly about 5-10% of the total items

while its value may be about 80% of the total value of the inventory.

Items in class ‘B’ constitute intermediate position. These items

may be about 20-25% of the total items while the usage value may be about 15%

of the total value.

Items in class ‘C’ are the most negligible in value, about 65-75%

of the total quantity but the value may be about 5% of the total usage value of

the inventory.

The numbers given above are just indicative, actual numbers may

vary from situation to situation. The principle to be followed is that the high

value items should be controlled more carefully while items having small value

though large in numbers can be controlled periodically.

Advantages

of ABC analysis

a. Reduction in investment: under ABC analysis, the materials from

group 'A' are purchase in lower quantities as much as possible. With this, the

effort to reduce the delivery period is also made. These in turn help to reduce

the investment in material.

b.

Optimization of Inventory management function: Each

class of the inventory gets management attention as per its value and

accordingly, manpower is allocated and expenses are incurred to manage it. It

ensures that most important items are regularly monitored and closely observed

whereas such efforts are expended with for the less important items.

c. Control on high value material: under ABC analysis, strict control can

be exercised to the materials in group 'A' that have higher value.

d. Reduction in Storage cost: Since Class “A” material is of high

value and are purchase in lower quantities as much as possible, it reduces the

total storage cost.

e. Saving in time and cost: Since a signification effort is made for

management of the material from group 'A', it helps to save time as well as

cost.

f. Opportunity to convert Class B items into Class A: As Class B

items hold potential for growth, the business may tap into this opportunity and

convert it frequent yet low-value customers into regular, high-value customers

to Class A.

Disadvantage of ABC analysis

a) No Proper classification of material: ABC

analysis will not be effective if the material are not classified into the

groups properly.

b) Not suitable if materials are of same value: It

is not suitable for the organization where the costs of materials do not vary

significantly.

c) No scientific base: There is no any scientific

base for the classification of material under ABC analysis.

d) Not suitable for small organisation: The

classification of the materials into different groups may lead to extra cost.

Hence, it may not be suitable for small organization.

2. List the actual cost methods used for

pricing the materials issued to production. Explain any one method with its

advantages and disadvantages. 2+8

METHODS OF PRICING

OF MATERIAL

A number of methods are used for pricing material issues. Each method has its own advantages and disadvantages. As such, it is impossible to say which method is the best. Each organisation should choose a particular method best suited to it. While choosing a method, it is necessary to see that the method chosen is simple, effective and realistic. At the same time, it is equally necessary to consider the effect of the method on production cost and inventory valuation. The following are the different methods of pricing the material issues:

First In First Out Method (FIFO)

According to this method the units first entering the process are completed first. Thus the units completed during a period would consist partly of the units which were incomplete at the beginning of the period and partly of the units introduced during the period. The cost of completed units is affected by the value of the opening inventory, which is based on the cost of the previous period. The closing inventory of work-in-process is valued at its current cost.

Advantages:

a. This method is simple to understand and easy to operate.

b. The closing stock is valued at the current market price.

c. Since issues are priced at cost, no profit or loss arises from pricing.

d. This method is more suitable in times of falling prices.

e. Deterioration and obsolescence can be avoided.

Disadvantages:

a. When prices fluctuate, calculation becomes complicated. This increases the possibility of clerical errors.

b. During the period of price fluctuations, material charged to jobs vary. Therefore, comparison between jobs is difficult.

c. During the period of rising prices, product costs are under stated and profits are overstated. This may result in payment of higher dividend out of capital.

Last

In First Out Method (LIFO)

According to this method units last entering the process are to be completed first. The completed units will be shown at their current cost and the closing-work in process will continue to appear at the cost of the opening inventory of work-in-progress along with current cost of work in progress if any.

Advantages:

a. Issues are based on actual cost.

b. Issue price reflects current market price.

c. Product cost will be based on current market price and hence will be more realistic.

d. There is no unrealized profit or loss.

e. Simple to operate if purchases are not many and prices are steady or rising.

f. When prices are raising this method is helpful in preparation of quotation or estimates.

Disadvantages:

a. This method involves considerable clerical work.

b. Under felling price, issues are priced at lower prices and stocks are valued at higher rates.

c. Stock of material shown in the balance sheet will not reflect market price.

d. Due to variation in prices, comparison of cost of similar job is difficult.

e. This method is not accepted by the income tax authorities.

Simple

Average Method

The simple average is determined by adding different prices of materials in stock and dividing the total by number of prices. Quantity purchased in each lot is ignored.

Advantages:

a. This method is simple to understand and easy to operate.

b. It reduces clerical work.

c. It is suitable when price are stable.

Disadvantages:

a. It does not take into account the quantities purchased.

b. The value of closing stock becomes unrealistic.

c. Material cost does not represent actual cost price.

d. When prices fluctuate, this method will give incorrect result.

Weighted

Average Method:

This is an improvement over the simple average method. This method takes into account both quantity and price for arriving at the average price. The weighted average is obtained by dividing the total cost of material in the stock by total quantity of material in the stock.

Advantages:

a. It gives more accurate results than simple average price because it considers both quantity as well as price.

b. It evens out the effect of price fluctuations. All jobs are charged a average price. So, comparison between jobs is more easy and realistic.

c. It is suitable in the case of materials subject to wide price fluctuations.

d. It is acceptable to income tax authorities.

Disadvantages:

a. Stock on hand does not represent current market price.

b. When large numbers of purchases are made at different rates, the calculation is tedious. So, there are more chances of clerical error.

c. With some approximation in average price, there will be profit or loss due to over or under charging of material cost to jobs.

3. What do you mean by 'Overheads'? How will

you apportion the common factory overheads to various production and service

departments? Explain with examples. 10

Aggregate of all expenses relating to indirect material cost, indirect labour cost and indirect expenses is known as Overhead. Accordingly, all expenses other than direct material cost, direct wages and direct expenses are referred to as overhead.

According to Wheldon, Overhead may be defined as "the cost of indirect material, indirect labour and such other expenses including services as cannot conveniently be charged to a specific unit."

Blocker and WeItmer define overhead as follows: "Overhead costs are operating cost of a business enterprise which cannot be traced directly to a particular unit of output. Further such costs are invisible or unaccountable."

Bases of

Apportionment: Suitable

bases have to be found out for apportioning the items of overhead cost to

production and service departments and then for reapportionment of service

departments costs to other service and production departments. The basis

adopted should be such by which the expenses being apportioned must be

measurable by the basis adopted and there must be proper correlation between

the expenses and the basis. Therefore,

the common expenses have to be apportioned or distributed over the departments

on some equitable basis. The process of distribution is usually known as

‘Primary Distribution’.

Following are the main bases of overhead

apportionment utilised in manufacturing concerns:

(i) Direct Allocation: Overheads are directly allocated to

various departments on the basis of expenses for each department respectively.

Examples are: overtime premium of workers engaged in a particular department,

power (when separate meters are available), jobbing repairs etc.

(ii) Direct

Labour/Machine Hours: Under this

basis, the overhead expenses are distributed to various departments in the

ratio of total number of labour or machine hours worked in each department.

(iii) Value

of Materials Passing through Cost Centres: This basis is adopted for expenses

associated with material such as material handling expenses.

(iv) Direct

Wages: This method is used only for those items of expenses which are

booked with the amounts of wages, e.g., workers’ insurance, their contribution

to provident fund, workers’ compensation etc.

(v) Number

of Workers: This method is used for the apportionment of certain expenses as

welfare and recreation expenses, medical expenses, time keeping, supervision

etc.

(vi) Floor

Area of Departments: This basis is adopted for the apportionment

of certain expenses like lighting and heating, rent, rates, taxes, maintenance

on building, air conditioning, fire precaution services etc.

(vii) Capital

Values: In this method, the capital values of certain assets like

machinery and building are used as basis for the apportionment of certain

expenses e.g. rates, taxes, depreciation, maintenance, insurance charges of the

building etc.

(viii) Light

Points: This is used for apportioning lighting expenses.

(ix) Kilowatt

Hours: This basis is used for the apportionment of power expenses.

(x) Technical Estimates: This basis of apportionment is used for the apportionment of those expenses for which it is difficult, to find out any other basis of apportionment. This is used for distributing lighting, electric power, works manager’s salary, internal transport, steam, water charges etc. when these are used for processes.

SECTION — B

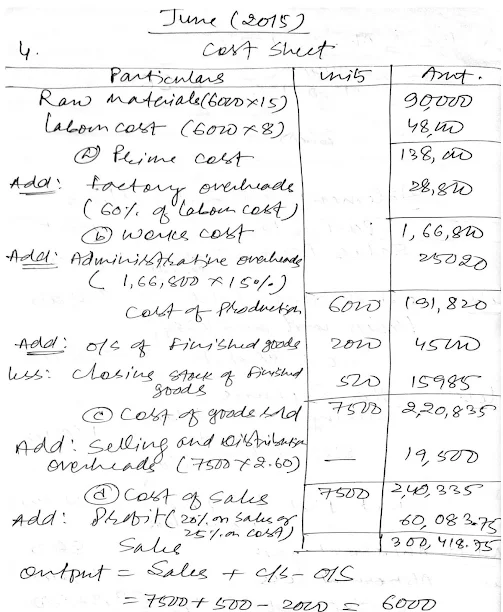

4. From the following information, prepare

cost sheet showing, (a) prime cost, (b) factory cost, (c) cost of goods

produced, (d) cost of sales (e) profit per unit. 15

|

Cost of Materials Labour cost Factory overheads Administrative overheads Selling and distribution overhead are

charged Opening stock of Finished goods Closing stock of finished goods, Sales 7,500 units at profit of |

@ Rs. 15 per unit of output @ Rs. 8 per unit of output @ 60% of labour cost Absorbed @ 15% of factory cost @ Rs. 2.60 per unit 2,000 units @ Rs. 22.50 per unit 500 units 20% on sales |

Note : Closing stock is to be valued at

production cost.

Solution:-

5. The manufacture of a product passes through

two 15 processes, I and II. The cost data relating to the product are given

below: 15

|

|

Process

I |

Process

II |

|

Units of raw materials introduced Cost per unit of raw materials (Rs.) Indirect materials (Rs.) Direct Labour (Hours) Hourly Rates (Rs.) Production overheads (Rs.) Normal wastage (of units) Sale value of normal wastage per unit (Rs.) Loss in weight Output (units) |

800 80 6,500 400 40 20,000 10% 8 2% 704 |

- - 8,000 300 40 15,000 5% 10 2% 680 |

Prepare Process Accounts showing the

calculation of Abnormal gains.

Solution:-

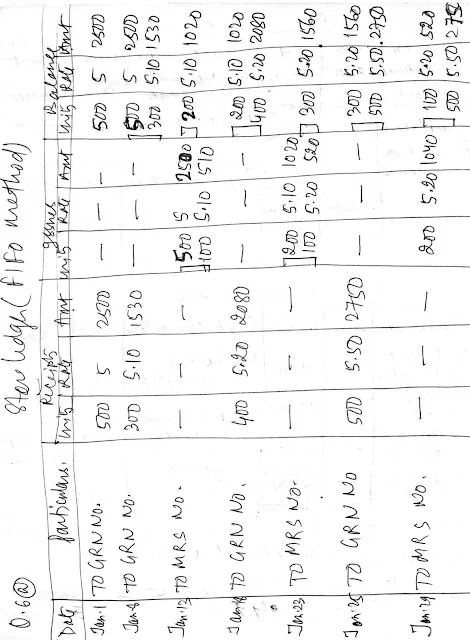

6. (a) In a factory, the following purchases

and issues of a material were made during the month, January 2014. Prepare the

stores Ledger Account according to FIFO method. 8

|

Date

(2014) |

Purchases |

Issues |

|

Jan.

1 Jan.

8 Jan.

13 Jan.

18 Jan.

23 Jan.

25 Jan.

29 |

500

Units @ Rs. 5 300

Units @ Rs. 5.10 - 400

Units @ Rs. 5.20 - 500

Units @ Rs. 5.50 - |

- - 600

Units - 300

Units - 200

Units |

Solution:-

(b) Explain with an example as to how you would ascertain the actual profit on an incomplete contract.

***

Post a Comment

Kindly give your valuable feedback to improve this website.