ECO 10 Solved Question Paper June 2014

ECO - 10: ELEMENTS OF COSTING SOLVED QUESTION PAPERS

ELEMENTS OF COSTING

IGNOU BCOM SOLVED QUESTION PAPERS

BACHELOR'S DEGREE PROGRAMME

Term-End Examination: June, 2014

ELECTIVE COURSE: COMMERCE

Time: 2 hours; Maximum Marks: 50; (Weightage: 70%)

Term-End Examination: June, 2014

ELECTIVE COURSE: COMMERCE

Time: 2 hours; Maximum Marks: 50; (Weightage: 70%)

Note: Attempt any two questions from Section-A and any two questions from Section-B.

Eco 10 Solved Question Papers Elements of Costing | |

SECTION - A

1. Describe the objectives of cost

accounting. In what way does cost accounting differ from financial

accounting? 4+6

Objectives/functions of

Cost Accounting

According to Blocker and Weltemer, “Cost

Accounting is to serve management in the execution of polices and in comparison

of actual and estimated results in order that the value of each policy may be

appraised and changed to meet the future conditions”. The main

objectives/functions of cost accounting are:

1) Ascertain Cost: To ascertain

the cost of product or a services reveled and enable measurement of profit by

proper valuation of inventory.

2) Analyse Costs: To

analysis costs or to classify the expenses under different heads of accounts

viz. material, labour, expenses etc.

3) Allocate and Apportion the Costs: To

allocate or charge the direct expenses or specific costs such as Raw Material,

Labour to particular product, contract or process and to distribute common

expenses to each product, contract or process on a suitable basis.

4) Cost Reporting: Cost

Reporting or presentation includes:

a) What to report i.e. what is the nature of

information to be presented?

b) Whom to Report i.e. to whom the report is

to be addressed.

c) When to Report i.e. when the report is to

be presented i.e. Daily weekly monthly yearly etc.

d) How to Report i.e. in what format the

report is to be presented.

DISTINGUISH

BETWEEN FINANCIAL AND COST ACCOUNTING

|

Basis |

Financial

Accounting |

Cost

Accounting |

|

1. Nature |

Financial

accounts are maintained on the basis of historical records. |

Cost

accounts lay emphasis on both historical and predetermined costs. |

|

2. Use |

Financial

Accounting is used even by outside entities. |

Cost

Accounting is used only the management of the concern. |

|

3. System |

Financial

Accounting uses the double-entry system for recording financial data. |

Cost

Accounting does not use the double-entry for collecting cost data. |

|

4. Scope |

Financial

Accounting covers all items of income and expenditure whether related to the

cost centers or not, |

Cost

Accounting covers all items related to a cost centre. |

|

5. Reports |

Financial

Accounting results are shown P&L A/c and balance sheet. |

Cost

Accounting results are shown in Cost Sheet/ Coating Profit & Loss A/c/

Reports Contract A/c/ Process A/c. |

|

6. Period |

Financial

Accounting is for a specific period. |

Cost

Accounting concentrates on cost centers and not on period. |

|

7. Stock

Valuation |

In

financial accounts, stocks are valued at cost or realisable value, whichever

is lesser. |

In cost accounts

stocks are valued at cost. |

|

8. Analysis

of Profit and Cost |

In

financial accounts, the Profit or Loss of the entire enterprise is disclosed

into. |

Cost

accounts reveal Profit of Loss of different products, departments separately. |

2. (a) Explain with the help of examples, the classification of

costs on the basis of identifiability with the products. 5+5

(b) What

do you mean by perpetual inventory system? State any three advantages of this

system.

Perpetual Inventory

System: Perpetual Inventory system means continuous stock taking. CIMA

defines perpetual inventory system as ‘the recording as they occur of receipts,

issues and the resulting balances of individual items of stock in either

quantity or quantity and value’. Under this system, a continuous record of

receipt and issue of materials is maintained by the stores department and the

information about the stock of materials is always available. Entries in the

Bin Card and the Stores Ledger are made after every receipt and issue and the

balance is reconciled on regular basis with the physical stock. The main

advantage of this system is that it avoids disruptions in the production caused

by periodic stock taking. Similarly it helps in having a detailed and more

reliable check on the stocks. The stock records are more reliable and stock

discrepancies are investigated and appropriate action is taken immediately.

Advantages of Perpetual Inventory System

a) Easy

detection of errors - Errors and frauds can be easily detected at an early

date. It helps in preventing their occurrence.

b) Better

control over stores- The system exercises better control over all receipts and

issues in such a manner so as to give a complete picture of both quantities and

values of stock in hand at all times.

c) No

interruption of production process- Production process is not interrupted as

the physical verification of stock is made on a planned and regular basis.

d) Acts as

internal check- Under the system, records are made simultaneously in the bin

cards and stores ledger accounts which acts as a system of internal check for

detection of errors as and when they are committed.

e) Investment

in materials kept under control - The investment in materials is kept at a

minimum level as the actual stock is continuously compared with the maximum

level and minimum level.

f) Early

detection of loss of stock- Loss of stock due to shrinkage, evaporation,

accident, fire, theft, etc. can be easily detected.

g) Accurate

and up-to-date accounting records- Due to continuous stocktaking, the

store-keeper and stores accountant become more vigilant in their works and they

maintain accurate and up-to-date records.

h) Easy to

prepare interim accounts- It is possible to prepare periodical profit and loss

account and balance sheet without physical stock-taking being made.

i)

Availability of correct stock data- Correct

stock data is readily available for settlement of insurance claims.

3. Write short notes on any two of the

following: 5+5

a)

Labour Turnover Rate.

b)

Reordering Level.

c)

Disposal of underabsorption and overabsorption

of factory overheads.

d)

Memorandum

Reconciliation Account.

PREPARATION ON RECONCILIATION STATEMENT

OR MEMORANDUM RECONCILIATION ACCOUNT

A Reconciliation Statement or a Memorandum Reconciliation Account

should be drawn: up for reconciling profits shown by the two sets of books.

Results shown by any sets of books may be taken as the base and necessary

adjustment should be made to arrive at the results shown by the other set of

books. The technique of preparing a Reconciliation Statement as well as a

Memorandum Reconciliation account is discussed below:

When there is a difference between the profits disclosed by cost

accounts and financial accounts, the following steps shall be taken to prepare

a Reconciliation Statement

1 Ascertain the various reasons of disagreement (as discussed

above) between the profits disclosed by two sets of books of accounts.

2. If profit as per cost accounts (or loss as per financial

accounts) are taken as the base:

ADD:

(i) Items of income included in financial accounts but not in cost

accounts.

(ii) Items of expenditures (as interest on capital, rent on owned

premises, etc.) included in cost accounts but not in financial accounts.

(iii) Amounts by which items of expenditure have been shown in

excess in cost accounts as compared to the corresponding entries in financial

accounts.

(iv) Amounts by which items of income have been shown in excess in

financial accounts as compared to the corresponding entries in cost accounts

(v) Over-absorption of overheads in cost accounts.

(vi) The amount by which closing stock of inventory is

under-valued in cost accounts.

(vii) The amount by which the opening stock of inventory is

over-valued in cost accounts.

DEDUCT:

(i) Items of income included in cost accounts but not in financial

accounts

(ii) Items of expenditure included in financial accounts but not

in cost accounts.

(iii) Amounts by which item of income have been shown in excess in

cost accounts over the corresponding entries in financial accounts.

(iv) Amounts by which items of expenditure have been shown in

excess in financial accounts over the corresponding entries in’ cost accounts.

(v) Under absorption of overheads in cost accounts.

(vi) The amount by which closing stock of inventory is over-valued

in cost accounts.

(vii) The amount b which the opening stock of inventory is under

-valued in cost accounts.

3. After making all the above additions and deductions, the

resulting figure will be profit as per financial accounts.

Note: If, profit as per financial accounts (or loss as per cost

accounts) is taken as the base, then items added shall be deducted and items to

be deducted shall be added, i.e., the procedure shall be reversed.

SECTION - B

4. With the help of the following

information from the cost of records of a manufacturing firm for a product for

a year, as certain (a) Total cost of production, (b) Cost of goods sold, (c)

Cost of sales and (d) Net profit for the year as well as per ton.

|

|

Rs. |

|

Purchase

of raw materials Factory

Rent and Insurance Carriage

Inwards Other

factory overheads Direct

wages Stock

at the beginning Raw

materials Finished

Goods (1000 tons) Administrative

overheads Sales

Stock

at the end Raw

materials Finished

Goods (2000 tons) |

12,00,000 80,000 14,400 4,00,000 6,00,000 2,00,000 1,50,000 2,84,000 29,90,000 2,22,400 ? |

There was no stock of work in progress

either at the beginning or at the end. Advertising and other selling costs were

Rs.10 per ton sold. During the year 16,000 tons of the product was produced.

Solution:-

5.

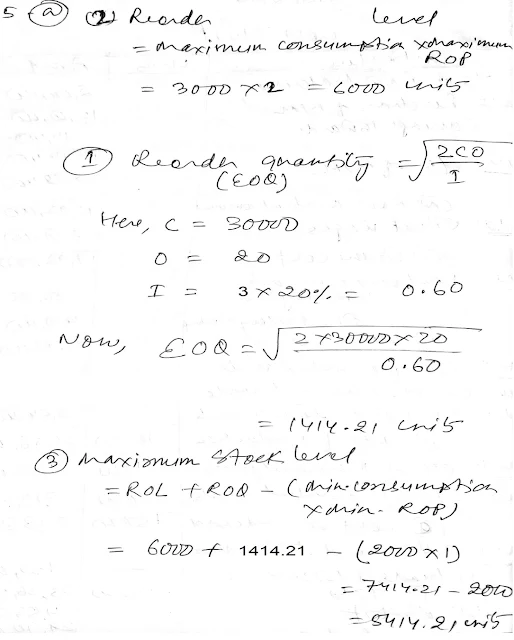

(a) From the following information,

compute: 9+6

1)

Reorder Quantity.

2)

Reorder Level.

3)

Maximum Stock Level and.

4)

Minimum Stock Level.

Annual

usage was 30,000 units, cost of materials per unit Rs. 3, cost of placing an

order Rs. 20, annual carrying cost of one unit 20% of inventory value and time

required for delivery 1 to 2 months. Normal consumption 2,500 units per month.

Maximum consumption 3,000 units per month and Minimum consumption 2,000 units

per month.

(b) What do you mean by normal and

abnormal process losses? How do you account for these losses in cost accounts?

Explain briefly.

6. (a) The production department of a factory gives

the following information for a month of

the current accounting year: 9+6

Materials

used Rs. 1,08,000; Direct wages Rs. 90,000; Factory overheads Rs. 72,000;

Labour hours worked 72,000 and Machine hours worked 60,000. For an order

executed during the month, the following information was recorded :

Materials

used Rs. 12,000; Direct wages Rs. 6,400; Labour hours worked 6,400 and Machine

hours worked 4,800. Compute the Overhead Absorption Rates and prepare a

statement showing cost of the job under :

1)

Direct Materials Cost Method;

2)

Direct Labour Cost Method;

3)

Labour Hour Rate; and

4)

Machine Hour Rate.

(b) The standard time allowed to

complete a job is 100 hours and the hourly rate of wage payment is Rs. 50. The

actual time taken by a worker to complete the Job is 80 hours. Compute the

total wages of the worker under :

1)

Halsey

Plan and

2)

Rowan

Plan.

Solution:-

***

Post a Comment

Kindly give your valuable feedback to improve this website.