Portfolio Performance Evaluation

Unit 4 SAPM Notes

Sharpe and Treynor Portfolio Performance Measures

The Sharpe Measure

In this model, performance of a fund is evaluated on the basis of Sharpe Ratio, which is a ratio of returns generated by the fund over and above risk free rate of return and the total risk associated with it. According to Sharpe, it is the total risk of the fund that the investors are concerned about. So, the model evaluates funds on the basis of reward per unit of total risk. Symbolically, it can be written as:

Sharpe

Index (St) = (Rt - Rf)/Sd

Where, St

= Sharpe’s Index

Rt=

represents return on fund and

Rf=

is risk free rate of return.

Sd=

is the standard deviation

While a high and positive Sharpe Ratio shows a superior

risk-adjusted performance of a fund, a low and negative Sharpe Ratio is an

indication of unfavorable performance. This index gives a measure of portfolios

total risk and variability of returns in relation to the risk premium. This

method ranks all portfolios on the basis of St. Larger the value of St, the

better the performance of the portfolio.

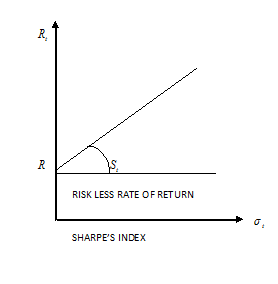

The following figure gives a graphic representation of Sharpe’s index. Sd measure the slope of the line emanating from the risk less rate outward to the portfolio in question.

|

Portfolio

|

Average

return

|

S.D.

|

Risk

Free Rate

|

|

A

|

15%

|

3%

|

9%

|

|

B

|

20%

|

8%

|

9%

|

Advantages of Sharpe’s Ratio:

a) The main advantage of this ratio is that it is easy to

calculate and it is used widely.

b) This index gives a measure of portfolios total risk and

variability of returns in relation to the risk premium.

c) The Sharpe ratio also

standardizes the relationship between risk and return and therefore can be used

to compare different asset classes i.e., comparison of stocks with commodities.

d) An advantage of Sharpe ratio is that a beta

estimate is not required.

Disadvantages of Sharpe ratio:

a) When risk free rate is known, it is very

difficult to find the right expected return and standard deviation. In a stable

market, it is very easy to predict expected return but in today’s dynamic

market it is very difficult to predict future expected return.

b) This ratio is not appropriate when evaluating

individual stocks because it uses total risk rather than systematic.

c) It is overstated if the return are smoothen

and historical prices are used.

d) It can be manipulated by the fund managers if non-linear derivatives are used.

The Treynor Measure

Jack L. Treynor based his model on the concept of characteristic

line. This line is the least square regression line relating the return to the

risk and beta is the slope of the line. The slope of the line measures

volatility. A steep slope means that the actual rate of return for the

portfolio is highly sensitive to market performance whereas a gentle slope

indicates that the actual rate of return for the portfolio is less sensitive to

market fluctuations.

The Treynor index, also commonly known as the reward-to-volatility

ratio, is a measure that quantifies return per unit of risk. This Index is a

ratio of return generated by the fund over and above risk free rate of return,

during a given period and systematic risk associated with it (beta). The portfolio beta is a measure of

portfolio volatility, which is used as a proxy for overall risk – specifically

risk that cannot be diversified. A beta of one indicates volatility on par with

the broader market, usually an equity index. A beta of 0.5 means half the

volatility of the market. Portfolios with twice the volatility of the market

would be given a beta of 2. Symbolically, Treynor’s ratio can be

represented as:

Treynor's

Index (Tt) = (Rt

– Rf)/Bt

Whereas,

Tt = Treynor’

measure of portfolio

Rt = Return of

the portfolio

Rf = Risk free

rate of return

Bt = Beta

coefficient or volatility of the portfolio

All risk-averse investors would like to maximize this value. While

a high and positive Treynor's Index shows a superior risk-adjusted performance

of a fund, a low and negative Treynor's Index is an indication of unfavorable

performance. Treynor ratios

can be used in both an ex-ante and ex-post sense. The ex-ante form of the ratio

uses expected values

for all variables, while the ex-post variation uses realized values.

|

Portfolio

|

Return

|

Volatility

|

Risk less Rate

|

|

A

|

20%

|

5%

|

8%

|

|

B

|

24%

|

8%

|

8%

|

Advantages of Treynor’s ratio:

a) The main advantage to the Treynor Ratio is that it indicates

the volatility a stock brings to an entire portfolio.

b) The Treynor Ratio should be used only as a

ranking mechanism for investments within the same sector. In a situation

where rate of return from various investments alternatives are same,

investments with higher Treynor Ratios are less risky and better managed.

c) It is proper measure for diversified

portfolio.

d) This method is easy to calculate and simple to

understand.

Limitations of Treynor’s ratio:

a) It is only a ranking criterion. It does not consider any values

or metrics calculated by means of the management of portfolios or investments.

b) A Treynor ratio is a backward-looking design. This ratio gives

importance to how the portfolio behaved in pas. It is possible that a portfolio

may perform differently in future from how it has done in the past.

c) Weakness of Treynor’s ratio is that it requires an estimate of

beta, which can differ a lot depending on the source which in turn can lead to

mis-measurement of risk adjusted return. Many investors accomplish that a beta

cannot give a clear picture of risk involved with the investment.

d) It can be overstated if market neutral strategies are used and

assets used in the portfolio are highly leveraged.